AccuWare is approved by GAZT for compliance with VAT (Value Added Tax) law of Saudi Arabia.

AccuWare VAT Features at a glance:

- Fully integrated tax accounting

- Ability to Create Tax Groups with %

- Binding Items with Tax Groups

- Enquire on items in specific Tax Group

- Tax group report

- VAT compliance in Purchase Orders and Returns

- VAT compliance in Sales Orders and Returns

- VAT compliance in Sales Quotations

- Automatic calculation of Tax amount

- Change the Tax group of an item in the transaction

- Automatic posting of tax to General Ledger

- Reports listing VAT collected from Customers

- Reports listing VAT Paid to Suppliers

- Report for Filing of Tax returns

Getting in touch with us is easy, just fill-in your contact details and submit the form below and one of our consultants will contact you.

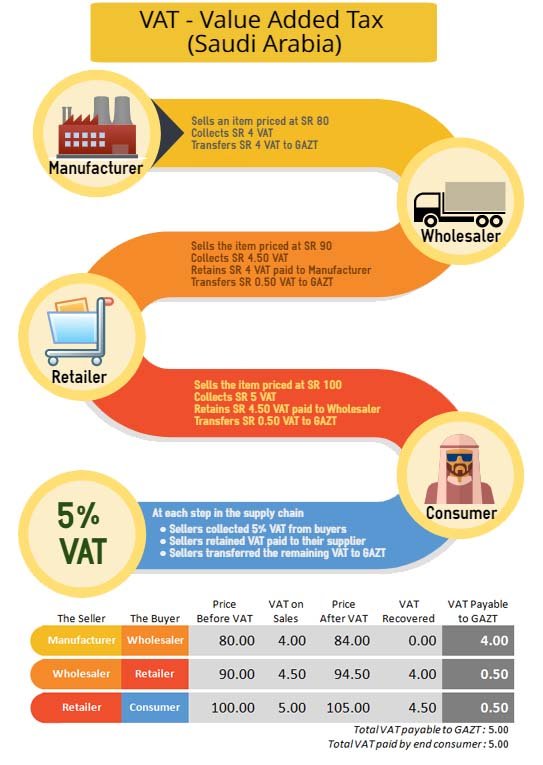

What is VAT?

Value Added Tax (or VAT) is an indirect tax imposed on all goods and services that are bought and sold by businesses, with a few exceptions. VAT is applied in more than 160 countries around the world as a reliable source of revenue for state budgets. VAT is imposed at each stage of the supply chain from the production and distribution to the final sale of the good or service.

Challenges in adopting VAT

- Billing System

- Skilled staffing

- Lack of technology systems

- Lack of infrastructure facilities

- Compliance with tax laws & regulations

- Provision of Points of Sale

- Increased responsibilities on business to continuously account, audit and file tax returns

When did VAT come into effect in Saudi Arabia?

VAT came into effect in Saudi Arabia on 1st January 2018 corresponding to Rabi Al-Thani 14, 1439 as part of the GCC Unified VAT Agreement.

Steps to Get ready for VAT: ( Small Business)

-

- Understanding VAT

- Develop a detailed understanding of VAT and determine tax policies of your products and services portfolio

- Align procurement processes

- Establish a system for recording and archiving invoices and suppliers details

- Align Sales

- Set in place a system to display prices, issue receipts and record sales

- Set in place a consistent means of display for the price of goods (all VAT inclusive)

- Issue sales receipts compliant with VAT requirements

- Align a system to record sales with VAT management requirements

- Calculation and Filing returns

- Set in place record keeping, VAT balance assessment and payment

- Understanding VAT

VAT law in Saudi Arabia

The Saudi Arabia Government has approved the final Kingdom of Saudi Arabia (KSA) Value-Added Tax (VAT) Law (the Law) and published the statute in the official gazette, Um Al Qura Edition 4681, on 28 July 2017.

The highlights of the Law are:

Effective date of implementation – Article 53 provides that the Law shall be effective from the beginning of the financial year following the date of publication of the Law in the official gazette. Accordingly, VAT will become effective in Saudi Arabia on 1st January 2018.

Scope of levy:

Article 2 provides that all imports, and the supply of goods and services, shall be subject to VAT in accordance with the provisions of the Gulf Cooperation Council (GCC) VAT Framework Agreement, the Law and implementing regulations to be prescribed under the Law.

Tax rates:

The standard rate of VAT prescribed by the GCC VAT Framework is 5%; however, certain goods and services may be subject to a zero rate or exempt from the levy of VAT.

Registration

Article 53 states that every person required to register for VAT shall register with the General Authority for Zakat and Tax (GAZT).

Tax evasion & burden of proof

Article 39 provides that the burden of proof to support the absence of intention (for tax evasion) is with the taxable person.

Penalties

Tax evasion:

A fine of not less than the tax due and not more than three times the value of goods and services shall be imposed, subject to evasion.

Failure to apply for registration:

Any person who fails to apply for registration within the period specified in the regulations shall be fined SAR10,000 (US$2,666).

Submission of a false tax return to GAZT:

Any person who submits a false tax return to the GAZT, or amends the tax return after submitting it, or claims an incorrect amount of recoverable VAT, shall be fined with an amount equal to 50% of the difference between the tax calculated and the tax due. The Law empowers the GAZT to waive or reduce this penalty.

Failure to submit a tax return by the due date:

A fine of not less than 5% and not more than 25% of the value of tax that was required to be reported shall be imposed.

Failure to pay tax on the due date:

A fine equivalent to 5% of the value of the unpaid tax for each month or part thereof for which tax remains unpaid, shall be imposed.

Issuance of a tax invoice by a non-registered person:

A non-registered person shall be liable to a fine not exceeding SAR100,000 (US$26,660) for issuing a tax invoice without prejudice to any increased penalty provided by any other law.

Not maintaining invoices, books, records and accounting documents:

A fine of not more than SAR50,000 (US$13,330) for each tax period shall be imposed.

Preventing or obstructing officers of the GAZT from performing their duties:

A fine of not more than SAR50,000 for each tax period shall be imposed.

Violation of any other provisions of the Law or implementing regulations:

A fine of not more than SAR50,000 for each tax period shall be imposed. The penalties set out in the Law are without prejudice to any other penalties prescribed in any other laws. Further, the penalties mentioned above shall be payable over and above VAT due.

Penalty for repetition of offense:

If the same offense is repeated within three years from the date of final decision of the penalty, the fine may be doubled.

Time limit for filing an appeal:

An appeal may be filed against a decision of the competent judicial authority within 30 days from the date of notification of the decision. On the lapse of 30 days, the decision shall be deemed to be final and after that period, there is no right of appeal to any other judicial body.

Issuance of implementing regulations:

The Board of Directors of the GAZT shall issue the regulations within 30 days from the date of publication of the Law and the regulations shall come into effect from the date of the Law coming into force.

Transitional provision:

Article 21 provides that even if an invoice is issued or payment is made before the implementation or registration date, VAT shall be deemed to be due if the date of the supply of the goods and services is on or after the implementation or registration date.

The Law refers to the implementing regulations, which will provide more specific guidance on:

Requirements for registration:

- VAT grouping

- De-registration

- Transactions to be considered as nominal or deemed supplies

- Provisions determining the place of supply for goods and services

- Person’s place of residence

- Provisions determining the time of supply for goods and services

- Terms and conditions for claiming input tax deduction

- Content and form of tax invoice

- Content and form of tax return including conditions thereof

- Adjustments to tax invoices and tax returns

- Payment of tax and other dues relating to VAT

The original Law is published in Arabic. In case of a conflict between the original version (Arabic) and any translation, the Arabic version will prevail.

Next steps:

The Law specifies that persons with a gross annual turnover exceeding the mandatory threshold of SAR 375,000 (US$100,000) are required to register with the GAZT. Failure to register will give rise to a penalty of SAR 10,000. The GAZT has already published the implementing regulations in draft format and these draft regulations provide a set of comprehensive provisions on specific VAT requirements, including the business sectors that are zero-rated and exempt. The GAZT has opted to apply the standard 5% rate of VAT to most business transactions, and therefore, the scope of VAT is wide, with limited deviations from the standard rate.

The approval and publication of the VAT Law mandates that businesses must be ready to account for VAT from 1st January 2018. This leaves businesses with five months to prepare for VAT, which, for large businesses, represents a significant challenge. Although many large businesses have initiated studies to determine the impact of VAT on their operations, there is still a large section of the business community waiting for the enactment of the Law in order to commit financial budgets for VAT-readiness projects. Given the very short time frame to achieve VAT-readiness, it is important that all businesses initiate a VAT impact assessment immediately in order to determine the impact of VAT across their operations.

This assessment should consider the VAT impact on the following key areas:

- Finance and accounting

- IT and systems

- Tax and compliance

- Supply chain ― goods and services

- Contracts

- Sales and marketing

- Legal structure

- Human resources

The impact assessment should be used to develop a clear plan on the steps that must be taken to be ready for VAT by the go-live date of 1 January 2018.

Taxpayer Charter

The taxpayer charter sets out the minimum standards each taxpayer as an important member of the Kingdom’s business community, can expect from the General Authority of Zakat and Tax (GAZT), and addresses the expectations that GAZT has of the taxpayer.

Click the following links to learn more about:

- What a taxpayer could expect from GAZT [https://vat.gov.sa/en/about-vat/taxpayer-charter]

- What GAZT expects from a taxpayer [https://vat.gov.sa/en/about-vat/taxpayer-charter]

About VAT

To know more about VAT in Saudi Arabia follow the links below:

- What is VAT? [https://vat.gov.sa/en/about-vat/what-is-vat]

FAQ

- General FAQ [https://vat.gov.sa/en/introduction-to-vat/faq/general-faqs]

- Technical FAQ [https://vat.gov.sa/en/introduction-to-vat-teh/faq/technical-faqs]

- Terms & Definitions [https://vat.gov.sa/en/introduction-to-vat/terms-definitions]

- Law & Regulations [https://vat.gov.sa/en/about-vat/law-regulations]

- Taxpayer Charter [https://vat.gov.sa/en/about-vat/taxpayer-charter]

VAT E-Services

Please login to https://vat.gov.sa/en/user/login for the following VAT e-services:

- VAT Readiness Tool

- VAT Registration

- VAT Returns

- VAT Payment and collections

- VAT Deregistration

- VAT Group Registration

Preparing Your Business

Large Businesses

- How to get informed [https://vat.gov.sa/en/preparing-your-business/large-businesses/how-to-get-informed]

- How to get ready [https://vat.gov.sa/en/preparing-your-business/large-businesses/how-to-get-ready]

SME Businesses

- How to get informed [https://vat.gov.sa/en/preparing-your-business/sme-businesses/how-to-get-informed]

- How to get ready [https://vat.gov.sa/en/preparing-your-business/sme-businesses/how-to-get-ready]

Registration is the process by which a taxable person is enrolled for VAT. Upon Registration a taxable person will be assigned a dedicated VAT account number.

Which businesses should register?

Mandatory Registration:

All companies, businesses or entities which make an annual taxable supply of goods and services in excess of SAR 375,000 are legally required to register for VAT by 20th December 2017.

However, all taxable persons whose annual taxable supplies exceed the mandatory Registration threshold but do not exceed SAR 1,000,000 will be exempted from the requirement to register until 20th December 2018.

Voluntary Registration:

Those which make an annual taxable supply of goods and services in excess of SAR 187,500 are eligible for voluntary Registration. Voluntary Registration provides significant benefits for the companies since it allows the deduction of input tax.

Registration of taxable persons not Resident in Saudi Arabia:

Non-Residents, who carry on economic activities but have no fixed place of business or fixed establishment in Saudi Arabia, will be required to register if they have the obligation to pay VAT in Saudi Arabia.

All Non-Resident taxable persons must have one Tax Representative established in Saudi Arabia and who is approved by GAZT. For further information about Tax Representatives or Agents, please follow the link: https://gazt.gov.sa

GAZT may request documentation from the taxable person to evidence that the above requirements are met.

How should a businesses register?

In order to register for VAT, businesses must first be registered at GAZT for Zakat and Income Tax.

Some large companies, particularly those already registered for other forms of tax in Saudi Arabia, will be auto-registered for VAT by GAZT.

- If this applies to your business, you will receive a notification from GAZT notifying you of this

- In that case, GAZT advises you to log-in to check the validity of the information and to upload any supporting documents you may have on the following link: https://gazt.gov.sa then click on user login

If your company is not auto-registered, registration is open since August 2017 to all eligible companies and businesses. You can register online on the following link: https://gazt.gov.sa then click on user login.

The Registration form will require you to specify:

- Whether you are an importer

- Whether you are an exporter

- IBAN number (for refunds) – not required if already logged with GAZT

- VAT eligibility start date

- VAT taxable supplies (expected over next 12 months)

- VAT taxable supplies (past 12 months)

- VAT taxable purchases (expected over next 12 months)

- VAT taxable purchases (past 12 months)

- Financial Representative details (only mandatory if you are not a Saudi resident)

A VAT eligible taxpayer pays VAT on his taxable purchases and collects VAT on his taxable supplies.

In essence, the taxpayer is collecting VAT on behalf of the General Authority of Zakat and Tax (GAZT) and has the right to claim back VAT paid on his taxable purchases.

Taxpayers will be required to file their returns to provide details of transactions related to taxable supplies and purchases. Following the submission of VAT return form, taxpayers will be asked to either pay the VAT liability or may claim back VAT refund depending on their situation. This set of activities is commonly referred to as VAT return filing.

GAZT has the right to issue a new assessment which adjusts a prior assessment, providing formal notice to the taxable person.

Who files VAT returns and when?

Taxable persons which make an annual taxable supply of goods and services in excess of SAR 40,000,000 will be required to file VAT returns monthly.

All other taxable persons will be required to file VAT returns quarterly. However, such persons may elect to file monthly returns subject to approval by GAZT.

From the end of the tax period (as defined above) all taxable persons will have one month to file their VAT return. For example:

- If monthly returns are required, for the tax period 1 January 2018 to 31 January 2018 the VAT return must be filed by 28 February 2018

- If instead quarterly returns are required, for the tax period 1 January 2018 to 31 March 2018, the VAT return must be filed by 30 April 2018

How to file VAT returns?

Taxable persons will need to file the VAT Return through the GAZT e-portal once available.

The VAT return form will require you to provide various details about your business during the tax period:

- Standard rated domestic sales

- Sales to registered customers in other GCC states

- Zero rated domestic sales

- Zero rated exports

- Exempt sales

- Standard rated domestic purchases

- Imports subject to VAT paid at customs

- Imports subject to VAT accounted for through the reverse charge mechanism

- Zero rated purchases

- Exempt purchases

- Corrections from previous period (up to 5,000 SAR)

- You will also need to specify any relevant adjustments

Note that for corrections (due to an error or omission) of more than 5,000 SAR, the taxpayer will need to complete a self-amendment.

Where the taxable person fails to file the VAT Return within the prescribed period, GAZT may make an assessment of the tax.

After a taxpayer files his returns, the payment process is initiated when a SADAD* invoice, containing the invoice number and the amount due, is automatically generated.

How to make a payment?

Once the SADAD invoice has been generated and sent to the taxpayer, the payment of Tax must be made to the designated bank account of the General Authority of Zakat and Tax (GAZT) through the SADAD payment gateway, either online or via the ATM. After the payment, the taxpayer will receive a payment receipt from GAZT. This will contain an attachment with the unique return reference number and the amount paid.

Payment application

The taxpayer can make a payment up to the total amount due in the SADAD bill. The payment received by GAZT will be applied to outstanding balances in the following order:

- Liabilities of the tax period specified in the SADAD bill

- Penalties of the tax period specified in the SADAD bill

- Penalties from previous tax periods, starting from the oldest period

Please note the following:

GAZT may offset any VAT credit balance against any other taxes due by the Taxpayer, however GAZT shall notify the Taxpayer where an offset of a credit balance has been carried out.

Installment payments

If a taxpayer presents evidence showing that he is unable to pay the Tax when due, or showing that he would suffer hardship from a single payment, GAZT may allow payment in installments of Tax and penalties, fines or charges payable.

The taxpayer would have to submit a request for paying the tax liability over a set number of months that do not exceed 12 months. The system will generate an installment schedule simulation that would be sent to the filing officer for approval. Once approved, the installment plan goes into effect.

For further information about installment payments please refer to the regulations article sixty.

When to make a payment?

VAT payment should be made following the submission of the VAT return (unless a refund is due to the taxpayer). Payment of Tax due by a Taxpayer in respect of a Tax Period must be made maximum by the last day of the month following the end of that Tax Period.

For a monthly filer, the payment deadline for the reporting period of 1st January to 31st January would be 28th February.

For a quarterly filer, the payment deadline for the reporting period of 1st January to 31st March would be 30th April.

Late payments will incur penalties added to the taxpayer’s account on the unpaid amount.

What happens if a taxpayer misses payment?

When a taxpayer misses a payment, a notification will be sent on the first day following the deadline to inform the taxpayer of the penalties imposed on him. If the payment is not made promptly, a formal non-payment notice is then sent to the taxpayer. The formal non-payment notice is followed by regular reminders to taxpayers. After a further period, if no response has been received, a collection case may be opened to collect dues via other means, which may include commercial sanctions or legal procedures.

Carry-forward and refunds

In the case that the return of the taxpayer results in a credit, the taxpayer has the option of requesting that credit to be carried forward to the subsequent period or requesting a refund.

Before a credit is carried forward or refunded, GAZT will validate the credit, and only after validating it, that it made available to the taxpayer to carry-forward or refund.

*SADAD Payment System (SADAD) is the national Electronic Bill Presentment and Payment (EBPP) service provider for the Kingdom of Saudi Arabia (KSA).

Common VAT related terminology is outlined in this section below with brief meanings:

VAT Tax

Value Added Tax (VAT) imposed on the import and supply of Goods and Services at each stage of production and distribution, including “Nominal Supplies”

Taxable Person

A Person that conducts an Economic Activity independently for the purpose of generating income, who is registered or obligated to register for VAT according to the Agreement

Agreement

The Unified VAT Agreement for the Council States

VAT Group

Two or more Legal Persons who are residents of Saudi Arabia registered as a single Taxable Person

Economic Activity

An activity that is conducted in a continuous and regular manner including commercial, industrial, agricultural or professional activities or Services or any use of material or immaterial property and any other similar activity

GAZT

General Authority for Zakat and Tax

Goods Imports

Goods entering any Member State from outside the Council Territory according to the provisions of the Unified Customs Law

Output Tax

The Tax due and chargeable in respect of any Supply of Taxable Goods or Services made by a Taxable Person

Input Tax

Tax payable by a Taxable Person with relation to Goods or Services supplied to or imported by such Taxable Person for the purpose of their Economic Activity

Net Tax

Tax resulting from deducting the Deductible Tax in a Member State from the Tax due in that State within the same Tax Period. Net Tax may either be payable or refundable.

Tax Invoice

Invoice issued in respect of Taxable Supplies meeting the requirements of the Law and Implementing Regulations

Exempted Supplies

Supplies on which no Tax is imposed and from which associated Input Tax as per the Agreement and Local Law is not deducted

Taxable Supplies

Supplies on which Tax is charged according to the Agreement, whether at the basic rate or zero-rate, and from which Input Tax is deducted as per the Agreement

Internal Supplies

Supplies of Goods or Services from a Supplier who resides in a Member State to a Customer who resides in another Member State

Reverse Charge (Mechanism)

A mechanism by which the Taxable Customer is obligated to pay the Tax due instead of the Supplier and is also liable for all the obligations stated in the Agreement and the Local Law

Mandatory Registration Threshold

The minimum value of actual supplies at which the Taxable Person becomes obligated to register for Tax purposes

Voluntary Registration Threshold

The minimum value of actual supplies at which the Taxable Person may apply to register for Tax purposes